Are you an SSS member paying your contributions voluntarily or through your current employer?

Do you want to know how much you are supposed to pay now for your SSS contributions?

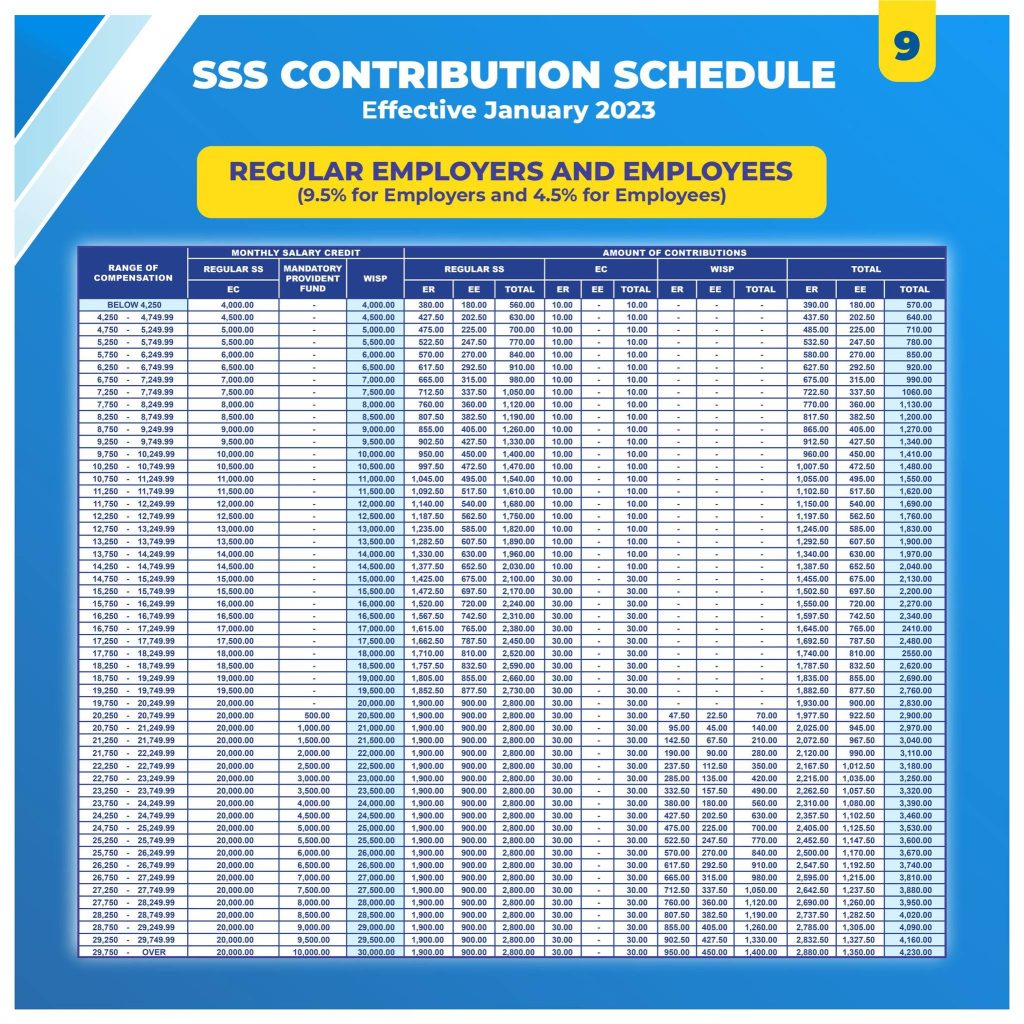

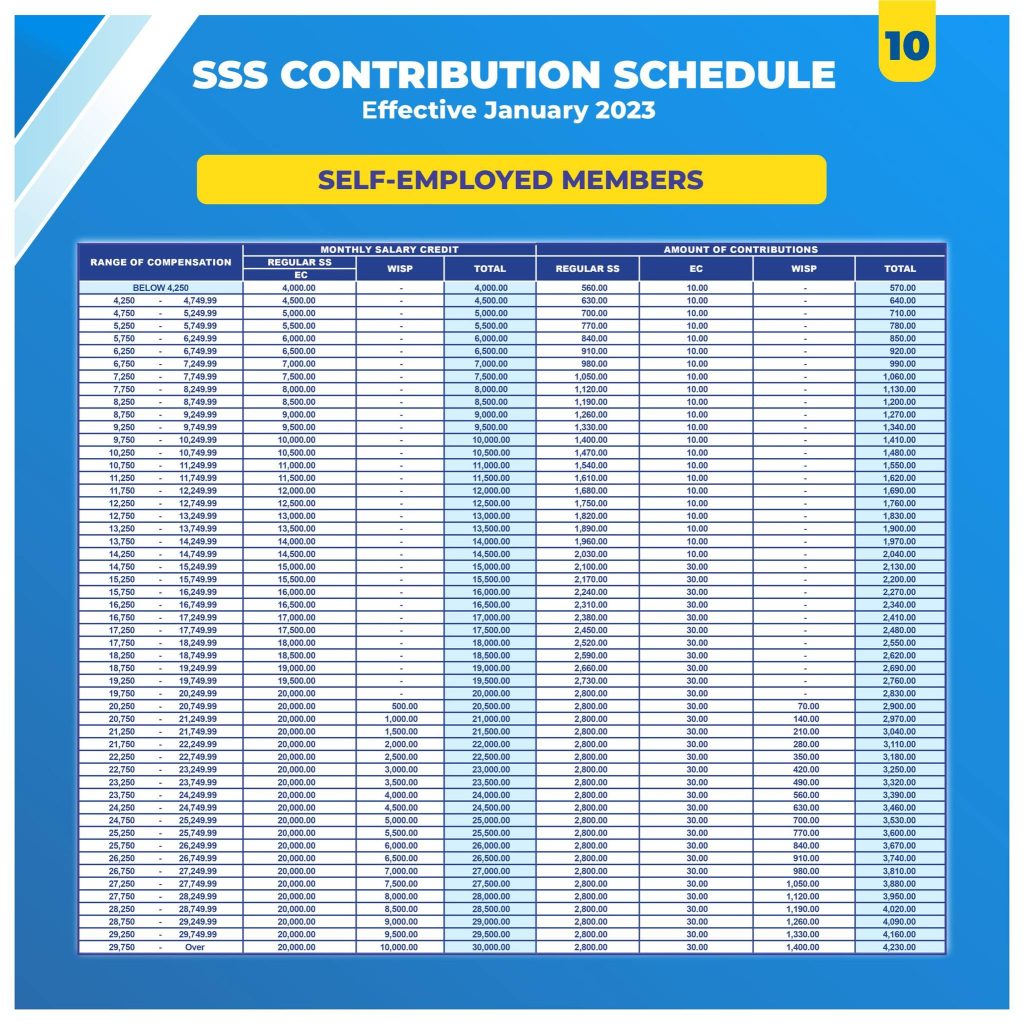

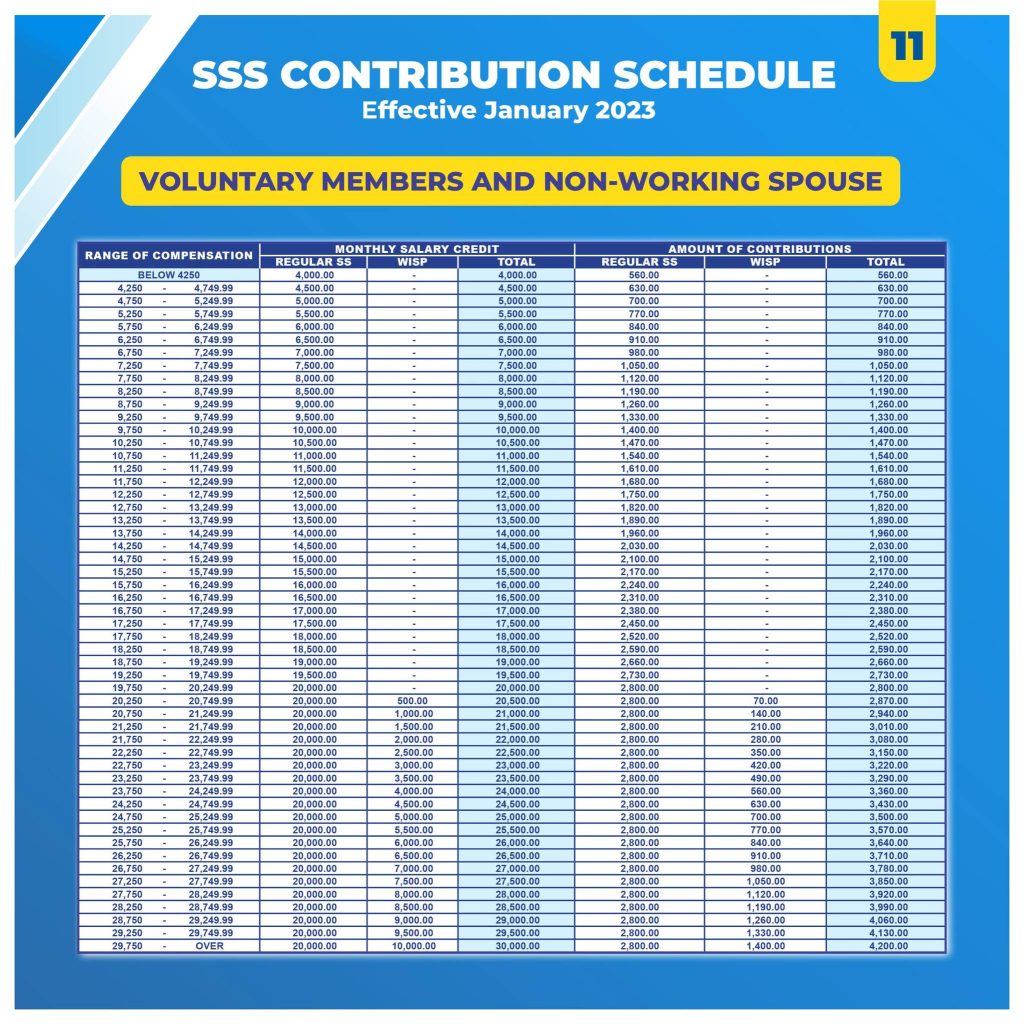

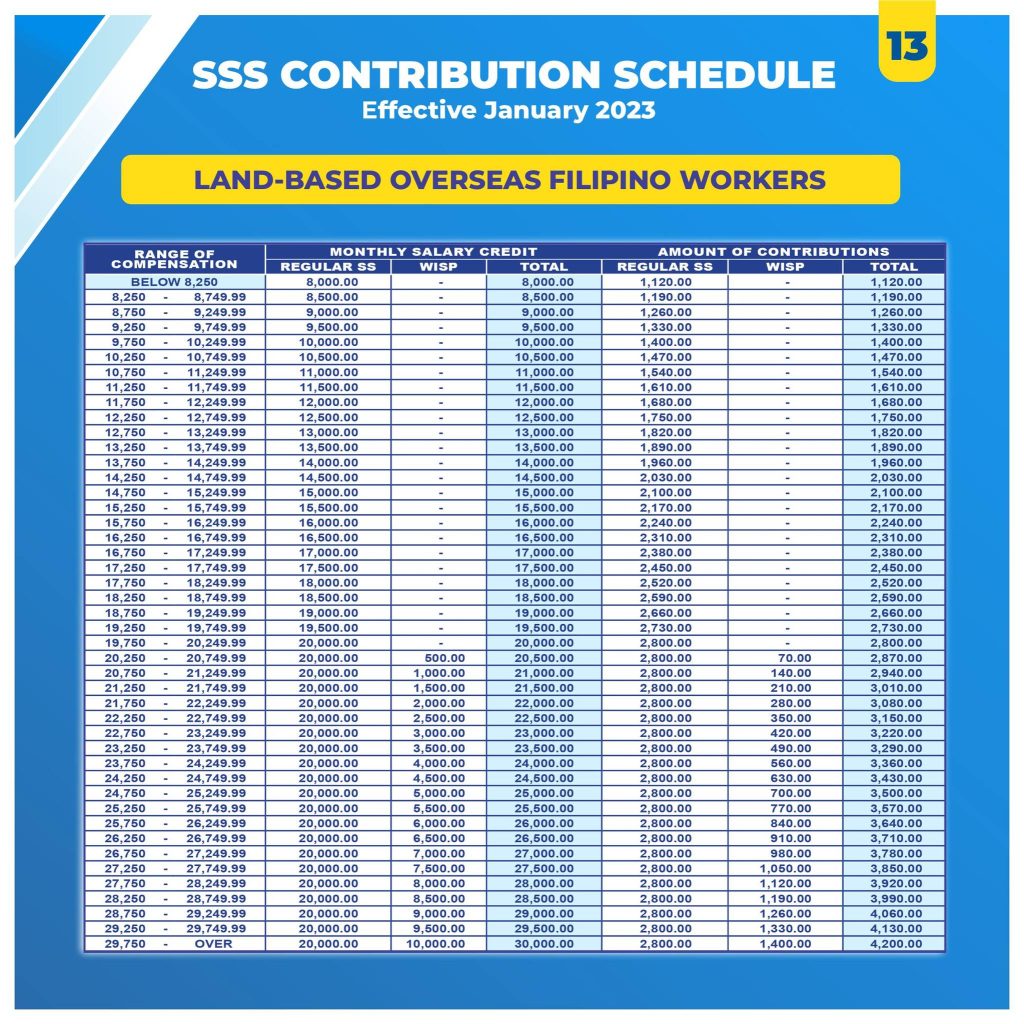

The SSS Contribution Table 2023 has recently been updated and revised to reflect the changes in contribution amounts.

This table is used by employees and employers to accurately compute their SSS contributions for the year. The table may also be utilized to determine the total amount of benefits an employee can receive from the SSS.

It is important to know your SSS Contribution Table 2023 so that you can plan your finances better, and avoid any penalties due to improper payments. Additionally, the table helps SSS contributors keep track of their contributions and plan for future benefits.

What’s new with the SSS Contribution Table 2023

- For Employers (ER) and Employees (EE) contributing at an MSC of ₱20,000 and below:

- Additional monthly SSS contributions range from ₱40 to ₱200, which will be paid by the employer only.

- For ER and EE contributing at the maximum MSC of ₱30,000:

- Additional amount of monthly SSS contributions is ₱950, with ₱225 coming from the employee, and ₱725 from the employer.

- Additional amount of monthly SSS contributions is ₱950, with ₱225 coming from the employee, and ₱725 from the employer.

- For Self-Employed (SE) Members contributing at an MSC of ₱20,000 and below:

- Additional monthly SSS contributions range from ₱40 to ₱200.

- For SE Members contributing at the maximum MSC of ₱30,000:

- Additional amount of monthly SSS contributions is ₱950.

- Additional amount of monthly SSS contributions is ₱950.

- For Voluntary Members (VM) and Non-Working Spouses (NWS) contributing at an MSC of ₱20,000 and below:

- Additional monthly SSS contributions range from ₱40 to ₱200.

- For VM and NWS contributing at the maximum MSC of ₱30,000:

- Additional amount of monthly SSS contributions is ₱950.

- Additional amount of monthly SSS contributions is ₱950.

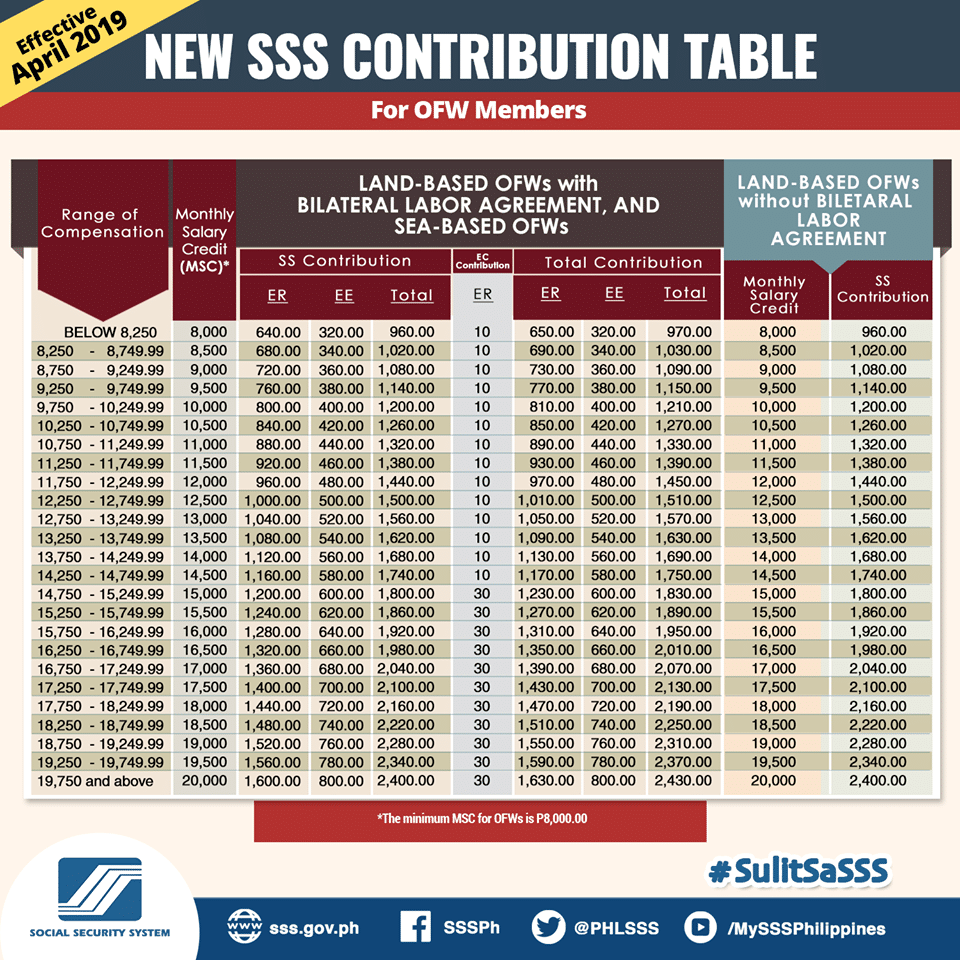

- For Land-Based Overseas Filipino Workers (OFWs) contributing at an MSC of ₱20,000 and below:

- Additional monthly SSS contributions range from ₱80 to ₱200.

- For Land-Based OFWs contributing at the maximum MSC of ₱30,000:

- Additional amount of monthly SSS contributions is ₱950.

- Additional amount of monthly SSS contributions is ₱950.

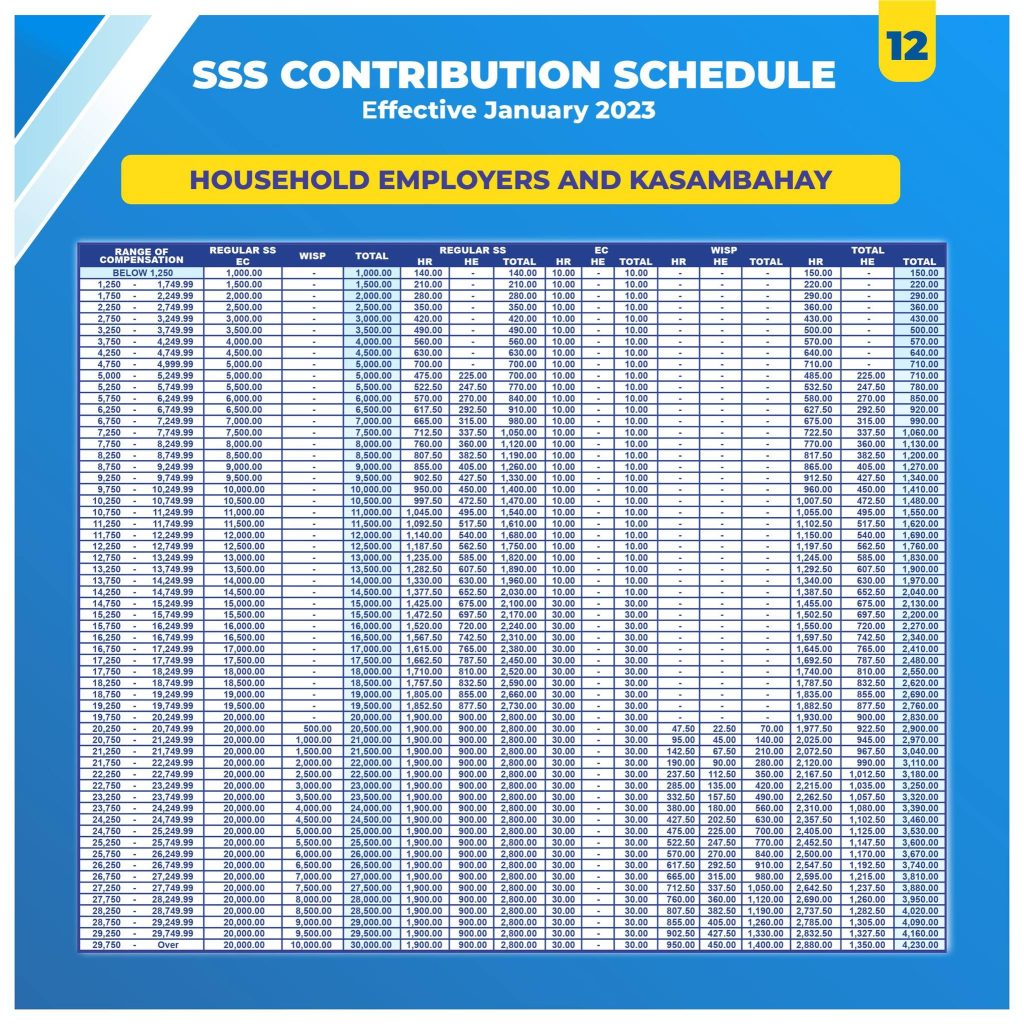

- For Household Employers (HHER) and Household Employees/Kasambahay (HHEE) contributing at an MSC of ₱20,000 and below:

- Additional monthly SSS contributions range from ₱10 to ₱200, which will be shouldered by the HHER only.

- For HHER and HHEE contributing at the maximum MSC of ₱30,000:

- Additional amount of monthly SSS contributions is ₱950, with ₱225 coming from the HHEE and ₱725 from the HHER.

Click here for more information about the New SSS Contribution Table 2023.

If you are an SSS member, whether you’re employed or self-employed or voluntary, it’s part of your responsibility to know when you’re supposed to pay your SSS contributions.

SSS members who are OFWs and non-working spouses must also know this so that you wouldn’t miss the deadline and hence pay on time.

Please take note that the Philippine Security System has already released the New SSS Contribution Table effective April 2019.

Click the link below to know more about it:

Please take note also that for self-employed, voluntary, non-working spouse and OFW members, you need to get your SSS PRN or Payment Reference Number to pay your SSS contributions.

Click the link below to know for more info about SSS PRN:

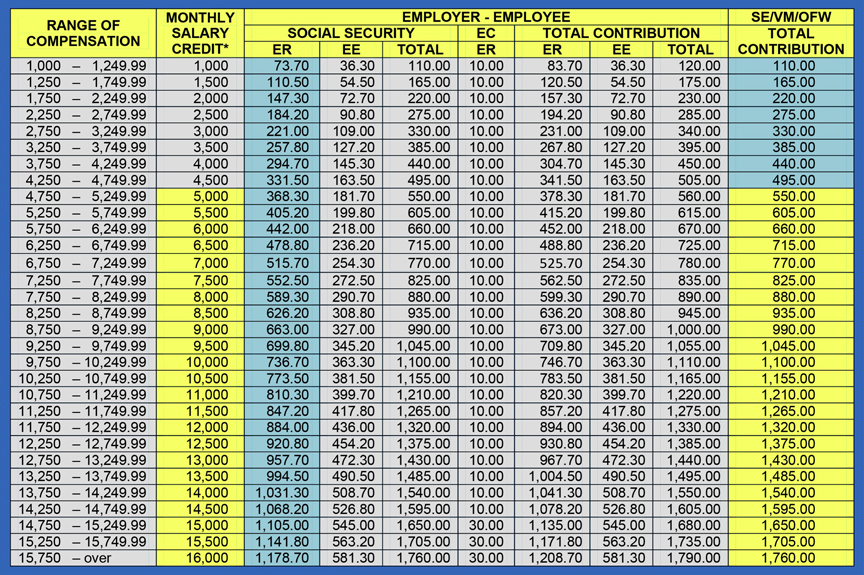

Previous SSS Contribution Table 2018

You may refer to the old SSS Contribution Table below to know how much you’re supposed to pay for the month of March 2019 or the first quarter of 2019.

Paying of SSS contribution and knowing when to settle it are made easier using the new SSS Contribution Table which you can see below.

Source: Philippine Social Security System

How much are you supposed to pay for your SSS Contribution?

The amount of your SSS monthly contribution is based on your compensation or how much you earn. Please take note that the current SSS contribution rate is 11% of the monthly salary credit not exceeding ₱16,000.

1. Employed Member – Your monthly contribution is being shared by you as the employee (3.63%) and your employer (7.37%).

2. Self-employed and Voluntary Members – You pay the full 11% of the monthly salary credit (MSC) for your SSS contribution based on your declared monthly earnings when you registered as SSS member.

3. OFW – You also pay the full 11% of your MSC but the minimum monthly salary credit is pegged at ₱5,000 or you should pay a minimum of ₱550 per month.

4. Non-working Spouse – Your SSS contribution will be based on 50% of your working spouse’s last posted monthly salary credit but please take note that it should not be lower than ₱1,000.

Therefore, the minimum amount that you can pay for your SSS contribution is P110, which is also the lowest contribution in the new SSS Contribution Table 2018.

When are your supposed to pay for your SSS Contribution?

Like some other financial or investment companies, not being able to pay on time could mean incurring penalties or delays in the processing of your loans or benefits.

That’s why as a member of the Philippine Social Security System, you should also be responsible in paying your SSS contributions and SSS loans on or before its due date.

Below is the table or guide for SSS Contribution Payment Schedule and Due Dates.

A. For Employed Members

If you are employed or you work for an employer or company, it’s your employer’s task to deduct your share from your salary and your company’s share to pay for your monthly SSS contribution.

In short, your employer must pay your SSS contribution monthly in accordance with the prescribed schedule of payment (refer to the table above), which is according to the 10th digit of the Employer’s ID Number.

For business employers and household employers, please take note that you’re supposed to pay your employee’s SSS contribution on a monthly basis.

B. For Self-employed and Voluntary Members

If you are a self-employed or a voluntary member of SSS, your deadline of payment for your SSS contribution is also based on the 10th or last digit of your SSS number.

In terms of the frequency of your contribution, you can pay it either monthly or quarterly.

There are 4 quarters in a year and a quarter covers three 3 consecutive calendar months

- Quarter 1: January, February, March

- Quarter 2: April, May, June

- Quarter 3: July, August, September

- Quarter 4: October, November, December

You can pay for one month, or two months, or three months (1 quarter) but make sure to pay it before the deadline.

For example, if I’m a voluntary member and the last digit of my SSS number is 1 and I want to pay my SSS contribution for the second quarter (April, May, June), the deadline for my payment is on July 10.

Why July 10?

Because the last digit of my SSS number is 1 and the deadline for payment falls on the 10th day of the month following the last month of the quarter that I wanted to pay (the last month of the second quarter is June).

Just refer back to the table above if you still find my example confusing.

C. For OFWs

If you are an OFW member, you are allowed to pay your SSS contributions for the entire year (January to December) within the same year.

You can also pay your contributions for the months of October to December of a given year on or before January 31 of the succeeding year.

Why should you pay your SSS contribution on time?

SSS provides various benefits based on the contributions that the member has made.

We should pay our contributions on time to avoid penalties and so that we can avail of the SSS benefits without delays or any issues in times of need.

The SSS Contribution Table 2018 is your handy guide to make sure that you don’t skip or miss the deadline for your SSS contribution payments.

RELATED ARTICLES:

when po uli may condonation please.

Are there any changes expected in 2024?