Tired of missing out on the exclusive perks and rewards that come with a Citibank credit card in the Philippines?

Do you find the application process confusing and overwhelming?

Fear not, as we’re here to help! In this guide, we’ll take you on a journey through the ins and outs of applying for a Citibank credit card in the Philippines.

From uncovering the eligibility requirements to navigating the application process, we’ll equip you with all the knowledge you need to secure your very own Citibank credit card.

Whether you’re a credit card newbie or a seasoned pro, this guide is your one-stop shop for getting the Citibank credit card that’s tailored to your lifestyle.

So, sit back, relax, and let’s dive into the world of Citibank credit cards in the Philippines!

My Citibank Credit Card Review

I had my Citibank Credit Card in 2015 when I attended a conference at SMX MOA. Citibank was one of the event sponsors and while I was checking the booths at the conference hall, I was approached by one of their representatives who offered me the Citibank Rewards Credit Card.

I got hooked by the good features and benefits of the Citibank Rewards Credit Card, so I filled out the application form hoping that it would be approved soon.

True enough, just a few days later, I received a call from Citibank. The representative did some quick verification of my personal information. Afterward, I was told that my Citibank Credit Card Application was approved and my new Citibank Rewards Credit Card was delivered to my address.

The initial credit limit that was given to me was only P35,000. It may seem to be a small amount, but I find it perfect because it allows me to manage my credit card easily without going over-limit or making impulsive or non-important purchases.

As of 2023, I still have my Citibank Rewards Credit Card and my credit limit is now at P83,000. I use it mostly for groceries and some online purchases, and I’m glad I never had any issues with it for the past 9 years.

Want to have your own credit card, click here to apply for a Citibank Credit Card.

5 Steps to Apply for a Citibank Credit Card in the Philippines

If you’re looking to apply for a credit card in the Philippines, Citibank is one of the most popular options available. With a Citibank credit card, you can enjoy a range of benefits such as cashback rewards, discounts, and installment plans.

But how do you go about applying for one?

In this step-by-step guide, we’ll walk you through the process of applying for a Citibank credit card in the Philippines.

Before you start your application, it’s important to make sure you meet the eligibility requirements.

To apply for a Citibank credit card in the Philippines, you must be at least 21 years old, have a minimum income of P180,000 per year if you have another credit card, or P250,000 per year if you have no credit card, have an active landline or mobile phone number, and have a valid TIN, SSS, GSIS, or UMID number. Once you’ve confirmed that you meet these requirements, you can move on to the application process.

Applying for a Citibank credit card in the Philippines is a straightforward process that can be completed online or in-person.

In the next section, we’ll provide a step-by-step guide that will help you apply for a Citibank credit card in the Philippines, whether you choose to apply online or in-person.

Step 1: Check Eligibility

Before applying for a Citibank credit card in the Philippines, you need to check your eligibility. Citibank has certain requirements that you need to meet in order to be approved for a credit card. Here are the basic eligibility criteria:

- You must be at least 21 years old.

- You must have a valid Philippine billing address.

- You must have a minimum annual income of PHP 180,000.

- You must have a landline or mobile phone number.

- You must have a valid email address.

If you meet these requirements, you can proceed to the next step and choose the Citibank credit card that best suits your needs. If you do not meet these requirements, you may want to consider other credit card options or work on improving your financial situation before applying for a Citibank credit card.

Step 2: Choose a Citibank Credit Card

After determining your eligibility for a Citibank credit card, the next step is to choose the right one for your needs. Citibank offers a wide range of credit cards with various features, benefits, and rewards. Here are some factors to consider when choosing a Citibank credit card:

Types of Citibank Credit Cards

Citibank offers different types of credit cards to suit different lifestyles and spending habits. Here are some of the most popular types of Citibank credit cards:

- Rewards Credit Cards: These credit cards offer rewards points or cashback for every purchase you make. You can redeem your rewards points for various items such as gift cards, merchandise, or travel vouchers.

- Airmiles Credit Cards: These credit cards allow you to earn airmiles for every purchase you make. You can redeem your airmiles for free flights, hotel stays, or other travel-related expenses.

- Cashback Credit Cards: These credit cards offer cashback for every purchase you make. The cashback is usually a percentage of your total spending and can be credited to your account or redeemed for other rewards.

- Low-Interest Credit Cards: These credit cards offer lower interest rates than other credit cards. They are ideal for people who carry a balance on their credit card and want to save on interest charges.

- Business Credit Cards: These credit cards are designed for small business owners and offer features such as expense management, employee cards, and rewards for business-related expenses.

Consider your spending habits and lifestyle when choosing a Citibank credit card. For example, if you travel frequently, an airmiles credit card may be a good choice for you. If you prefer cashback, a cashback credit card may be a better option. If you own a small business, a business credit card may be more suitable for your needs.

Once you have identified the type of credit card you need, compare the different Citibank credit cards within that category to find the one that best suits your needs. Look at the annual fees, interest rates, rewards programs, and other features to make an informed decision.

Step 3: Gather Required Documents

Before you proceed with your Citibank credit card application, make sure you have all the necessary documents on hand. Having all the required documents ready will help speed up the application process and increase your chances of getting approved.

The following are the documents you need to prepare:

- Valid government-issued ID – This can be your passport, driver’s license, or any other government-issued ID with your photo and signature.

- Proof of income – This can be your latest payslip, income tax return (ITR), or certificate of employment. If you’re self-employed, you can submit your business registration documents or bank statements.

- Proof of billing – This can be any utility bill or credit card statement that shows your name and current address.

It’s important to note that Citibank may require additional documents depending on your employment status or credit history. Make sure to check with Citibank or refer to their website for the complete list of requirements.

Once you have all the necessary documents, make sure to keep them organized and readily accessible. This will help you fill out the application form accurately and efficiently.

Step 4: Fill Out the Application Form

Now that you have chosen the Citibank credit card that suits your needs and you have gathered all the necessary documents, it’s time to fill out the application form. You can do this online, through the Citibank mobile app, or in person at a Citibank branch.

If you choose to apply online, you will be directed to a secure online application form. Make sure to provide accurate and complete information. The application form will ask for your personal details, employment information, and financial information. You will also be asked to provide your contact information and to choose your preferred mode of statement delivery.

If you prefer to apply through the Citibank mobile app, simply download the app and follow the instructions. You will need to provide the same information as you would on the online application form.

If you prefer to apply in person, visit a Citibank branch near you. Bring all the necessary documents and ask for assistance from a Citibank representative. They will guide you through the application process and answer any questions you may have.

After you have completed the application form, make sure to review it carefully before submitting it. Double-check all the information you provided to ensure its accuracy. Once you submit the form, Citibank will review your application and notify you of the status of your application within a few days.

Step 5: Submit Your Application

Once you have filled out your application and double-checked all the information, you are ready to submit your application. There are a few ways to do this:

- Submit your application online by clicking the “Submit” button on the application form.

- Print out your application and mail it to the address provided on the form.

- Visit a Citibank branch and submit your application in person.

If you choose to submit your application online, you will receive an email confirmation that your application has been received. If you choose to mail in your application, it may take a few days for Citibank to receive and process it. If you submit your application in person at a branch, you will receive immediate confirmation that your application has been received.

After you have submitted your application, you will need to wait for Citibank to review it. This process typically takes a few business days, but can take longer if additional information is needed.

If your application is approved, you will receive your new Citibank credit card in the mail within a few weeks. If your application is not approved, Citibank will notify you of the decision and provide an explanation.

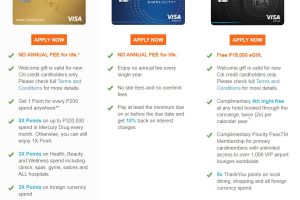

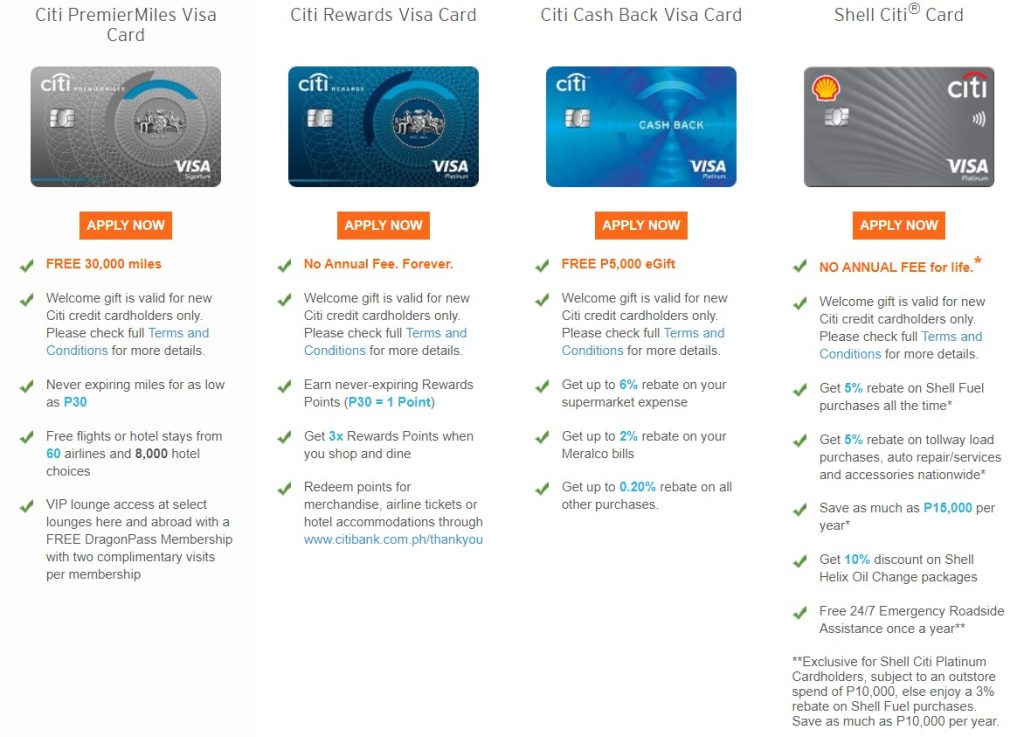

Citibank Credit Card Promo

Citibank regularly offers a promo for new Citibank Credit Card applicants. Here are the ongoing promo of Citibank Credit Cards this 2023.

- Citi PremierMiles Visa Card – FREE 30,000 miles

- Never expiring miles for as low as P30

- Free flights or hotel stays from 60 airlines and 8,000 hotel choices

- VIP lounge access at select lounges here and abroad with a FREE DragonPass Membership with two complimentary visits per membership

- Citi Rewards Visa Card – No Annual Fee. Forever

- Earn never-expiring Rewards Points (P30 = 1 Point)

- Get 3x Rewards Points when you shop and dine

- Redeem points for merchandise, airline tickets or hotel accommodations through www.citibank.com.ph/thankyou

- Citi Cash Back Visa Card – FREE P5,000 eGift

- Get up to 6% rebate on your supermarket expense

- Get up to 2% rebate on your Meralco bills

- Get up to 0.20% rebate on all other purchases.

- Shell Citi® Card – NO ANNUAL FEE for life

- Get 5% rebate on Shell Fuel purchases all the time

- Mercury Drug Citi® Card – NO ANNUAL FEE for life

- Get 1 Point for every P200 spend anywhere (Except drugstores other than Mercury Drug)

- Citi Simplicity+ Visa Card – NO ANNUAL FEE for life

- Pay at least the minimum due on or before the due date and get 10% back on interest charges

- Citi Prestige Visa Card – Free P18,000 eGift

- Complimentary 4th night free at any hotel booked through the concierge, twice (2x) per calendar year.*

Conclusion

Applying for a Citibank credit card in the Philippines is a straightforward process that can be completed in just a few simple steps. By ensuring that you meet the eligibility requirements and providing all the necessary documents, you can increase your chances of getting approved for a Citibank credit card.

Remember to carefully consider which Citibank credit card is right for you based on your needs and spending habits. Whether you’re looking for a card with no annual fee, one that offers cashback rewards, or one that provides exclusive travel benefits, Citibank has a credit card that can meet your needs.

Once you’ve received your Citibank credit card, be sure to use it responsibly and pay your bills on time to avoid late fees and interest charges. By doing so, you can build a positive credit history and improve your credit score over time.

Overall, applying for a Citibank credit card in the Philippines is a great way to access a range of benefits and rewards while also building your credit history. With a little bit of preparation and careful consideration, you can find the perfect Citibank credit card for your needs and start enjoying all the benefits that come with it.

READ: How to Pay Utility Bills Online Using a Credit Card

Benefits of using Citibank Credit Card

Because of my Citibank Credit Card, I’m able to buy some of the important things online and offline. I use it especially when booking flights online and when purchasing some really great deals online like in Metrodeal or Lazada.

When we moved to our new house early this year, we purchased a new fridge and a TV set using my Citibank Credit Card to avail of the 0% installment plan promo.

Having a credit card is really helpful because it made it easier for us to purchase expensive products or services by converting them to installment plans at no extra cost.

In addition to that, Citibank also offers promo discounts regularly at different merchants like in restaurants, hotels, and shopping malls, which really gives us the best value for our money.

It’s Good to Have a Credit Card – if you know how to handle it

Before, I was hesitant and skeptic about applying for a credit card because of the many horror stories I heard from some of my colleagues and other people who got buried in credit card debts.

I realized however, that using a credit card is pretty much like using cash, but it offers a lot more benefits than cash. If you ONLY know how to handle and manage your credit card efficiently and responsibly, you’ll get to enjoy the benefits that come with it without ever getting into debt.

How to Apply for Citibank Credit Card

Applying for a Citibank Credit Card is really simple.

Step 1

Go to the Citibank Credit Cards website or simply click HERE.

Step 2

Choose your preferred Citibank Credit Cards. I suggest you choose the one fits your needs or lifestyle.

1. CITI REWARDS® CARD

- Earn never-expiring Rewards Points (P30 = 1 Point)

- Get 3x Rewards Points when you shop and dine

- Redeem points for merchandise, airline tickets or hotel accommodations through www.citibank.com.ph/thankyou

- Use your points to pay for purchases at partner shops and cinemas nationwide.

2. CITI®PREMIERMILES®CARD

- Never-expiring miles for as low as P30

- Free flights or hotel stays from 60 airlines and 8,000 hotel choices

- Free local and international airport lounge access

- 24/7 Visa Signature Concierge service.

3. CITI CASH BACK®CARD

- Get up to 6% rebate on your supermarket expenses

- Get up to 2% rebate on your Meralco bills

- Get up to 0.20% rebate on all other purchases.

4. SHELL CITI® CARD

- Get up to 5% rebate on your Shell fuel expenses

- Get up to 5% rebate when you use your Shell Citi® Card to purchase South Luzon Expressway and North Luzon Expressway toll load

- Get up to 5% rebate on ALL auto repairs, accessories and services nationwide

5. MERCURY DRUG CITI® CARD

- Get up to 10% rebate on your Mercury Drug purchases and hospital bills.

Step 3

Once you have chosen your Citibank Credit Card here, the next step is to click Apply Now right below it.

Then, answer the questions on the page and fill out the Citibank Credit Card Application Form online.

Qualifications

- At least 21 years old

- A resident of the Philippines with a valid local billing address

- Earns at least ₱180,000 per year.

- Owns a postpaid landline or mobile phone

- Must present a Tax Identification Number (TIN) and SSS/GSIS number

Requirements

- A completely filled-out application form

- For Employed:

- 2 Government issued IDs

- An up-to-date Income Tax Return (ITR) duly stamped as received by the BIR

- W2 (BIR Form 2316)

- Latest payslip issued within the last 3 months

- Certificate of Employment

- 1 Photocopy of most recent credit card billing statement from other banks (If any)

- For Self-employed:

- Government issued IDs,

- An up-to-date audited financial statement (AFS) duly stamped as received by the BIR

- Official receipt of the latest Income Tax Return (ITR) duly stamped as received by the BIR

- A photocopy of your most recent credit card billing statement from other banks (if any)

- For Foreign Nationals:

- VISA

- Working Permit (with a validity of 1 year; not yet expired at time of application)

- OR Immigration Certificate of Residence (ICR)

- OR Alien Certificate of Registration (ACR – iCard type with permanent status)

Click here to Apply for Citibank Credit Card NOW!

This is fake. I haven’t received mine even if I complied with more than the minimum requirements.