A lot of SSS members resort to applying for an SSS loan in times of financial emergency.

Others, however, apply for SSS loan just to avail of this benefit even if they don’t have an urgent need for cash. They just want to try it and hoping that they will be able to apply for a higher loanable amount on their next loan application.

Either way, you can easily apply for an SSS loan and I’ll tell you the step-by-step process of SSS Loan Application in this article.

What is SSS Loan?

SSS Loan is a cash loan granted to an employed, self-employed or voluntary member as part of his/her benefits of being a member of the Philippine Social Security System.

Who Can Apply for SSS Loan?

- SSS members who are currently employed or currently-paying self-employed or voluntary members can apply for SSS Loan. You can apply for a one-month or two-month loan.

- To apply for a one-month loan, you must have 36 posted monthly contributions. 6 of which should be within the last 12 months prior to the month of filing of application.

- To apply for a two-month loan, you must have 72 posted monthly contributions. 6 of which should be within the last 12 months prior to the month of filing of application.

- If you’re employed, your employer must be updated in the payment of contributions.

- You must be under 65 years old at the time of application.

- You have not been granted final benefit like total permanent disability, retirement and death, and you have not been disqualified due to fraud committed against the SSS.

What are the SSS Loan Requirements

The requirements for SSS Loan Application will vary depending on who will file it.

1. If the SSS Loan Application is filed by the Member-Borrower

- Member Loan Application Form

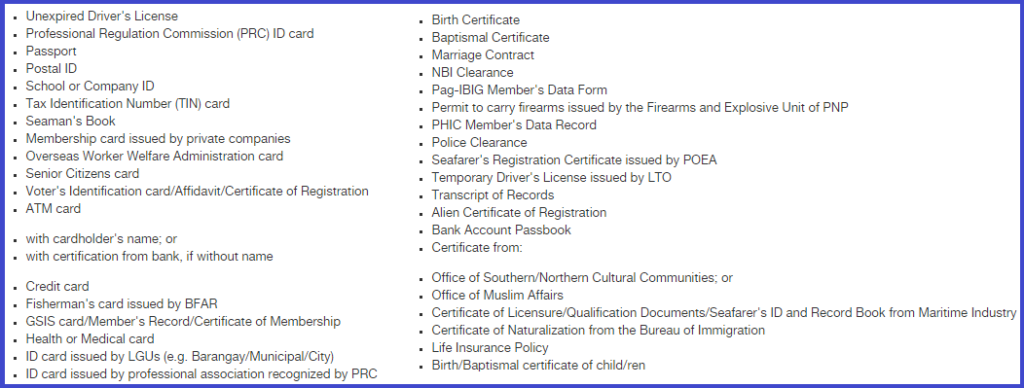

- SSS digitized ID or E-6 (acknowledgement stub) with any two valid IDs, one of which with recent photo.

2. If the SSS Loan Application is filed by Member-borrower’s Authorized Representative

- Member-borrower’s duly accomplished Member Loan Application

- Authorized Representative’s SS card or any two valid IDs both with signature and at least one with photo

- Letter of Authority (LOA) signed by both the member-borrower and member-borrower’s authorized representative

- Member-borrower’s SS card or any two valid IDs both with signature and at least one with photo.

3. If the SSS Loan Application is filed by Employer/Company’s Authorized Representative

- Member-borrower’s duly accomplished Member Loan Application

- Authorized Company Representative (ACR) card issued by SSS

- Letter of Authority (LOA) from employer and any two (2) valid IDs both with signature and at least one with photo

- Member-borrower’s SS card or in its absence, Application for SS card (SS Form E-6) acknowledgment stub and any two valid Ids both with signature and at least one with photo.

Please take note that original or certified true copies of the supporting documents should be presented during the filing of SSS Loan Application.

How to Get a Copy of SSS Loan Form

You can get a copy of the form at the SSS branch. You can also download the SSS Loan Form here.

For OFWs, you can get the SSS Loan Form at the SSS Foreign Representative Office if there’s one in your country, or just download it here.

How to Apply and File for SSS Loan?

- Prepare all the requirements above before applying for SSS loan.

- Submit and file the SSS Loan Application

- You can file personally at the nearest SSS branch

- You can file online if you’re registered in the SSS online platform, also called My.SSS

- If you’re employed, you can file your application personally through your employer or company HR

- If you’re employed, you can also file online through My.SSS, but your company must also be registered online because your application will be directed to your company’s account for certification

- If you’re an OFW member, you may file your loan application at the SSS Foreign Representative Offices, which are available in selected countries.

- If you’re an OFW member and there’s no SSS Foreign Representative Office in the country where you’re working at, just send your application and supporting documents to your relatives here in the Philippines and authorize them to file at the SSS branch.

Take note that documents issued in other country should be duly authenticated or certified by the Philippine Consulate Embassy.

Also, the employer shall submit an updated SS Form L-501 (Specimen Signature Card) and it should be updated annually to avoid delay in the processing of salary loan applications.

Steps for SSS Online Loan Application

The easiest way to apply for an SSS Loan is through My.SSS, or the SSS online platform.

But before you could do that, you first need to register your SSS account online. Click here for the steps on SSS Online Registration or watch this video tutorial.

Once you’re registered, follow these steps to apply for SSS Loan Online:

Step 1: Go to https://sss.gov.ph and login to your SSS online account with your User ID and Password.

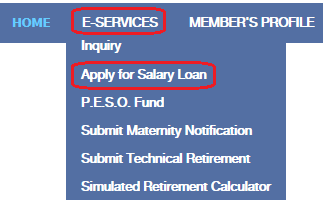

Step 2: Once logged in, look for E-Services then click Apply for Salary Loan

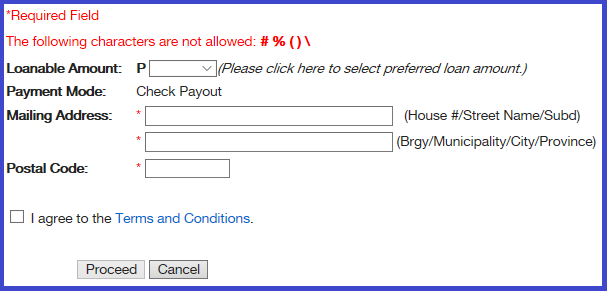

Step 3: Fill out the required field including the loanable amount, mailing address, and postal code. Then click the box to agree the terms and hit proceed.

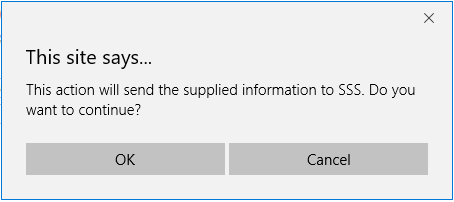

Step 4: This box will appear and click OK to confirm the submission of your SSS Loan Application online.

Note: I haven’t personally tried applying SSS Loan online and I’m not planning to do it as of the moment that’s why I cannot proceed to the next steps. I’m not sure what comes next after clicking OK, but if you want to proceed, just go ahead and follow the next steps. I guess you’d have to attach the application form and other requirements.

Watch this video tutorial:

How much can you loan from SSS?

1. One-month salary loan

This is equivalent to the average of the member-borrower’s latest posted 12 Monthly Salary Credits (MSCs), or amount applied for, whichever is lower.

2. Two-month salary loan

This is equivalent to twice the average of the member-borrower’s latest posted 12 Monthly Salary Credits (MSCs), rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

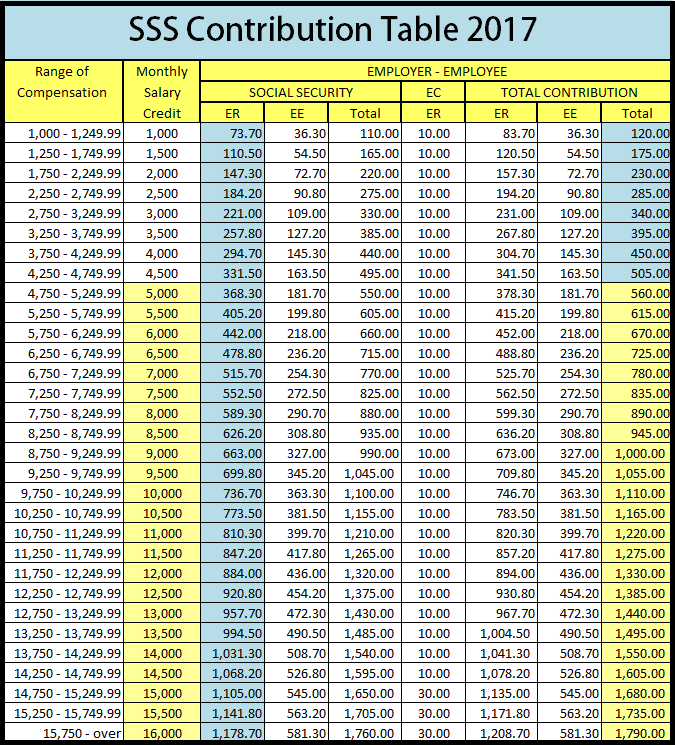

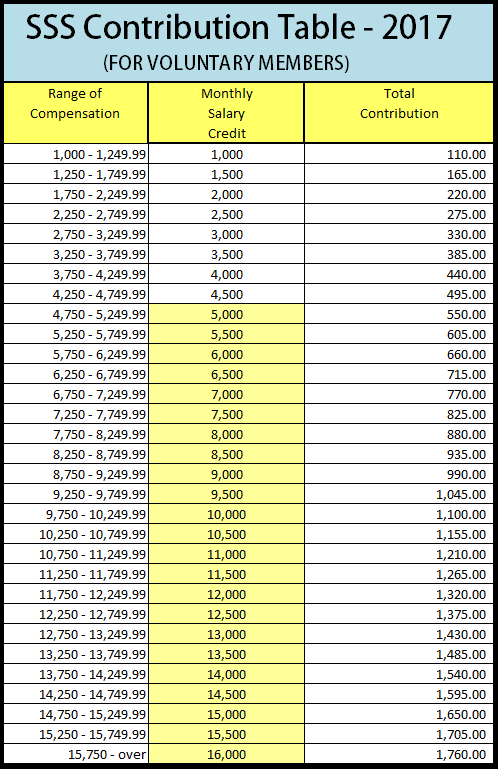

To know your Monthly Salary Credit, please refer to to the SSS Contribution Table 2017 below…

If you’re employed, check how much is your Total monthly contribution in the last column. Then check the second column to know your Monthly Salary Credit.

If you’re self-employed, voluntary or OFW member, check your Total Contribution in the last column. Then check the second column to know your Monthly Salary Credit.

Take note that this table is just a guide on how much you’re supposed to pay for your SSS contribution based on your compensation or salary. Your MSC will be based on how much you actually pay.

This is because some SSS members don’t follow this table and only choose to pay the amount that they’re comfortable with or that they can afford.

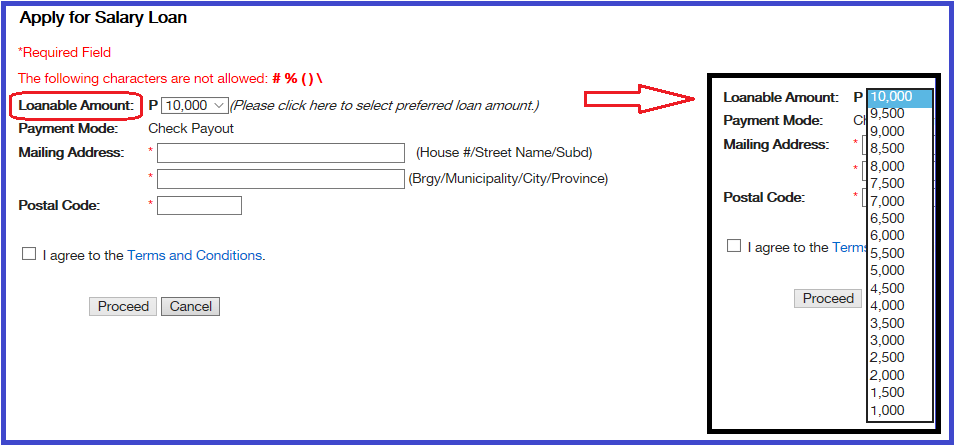

How to Check SSS Loan Amount Online?

If you are registered in SSS online, you will be able to check your loanable amount based on your contributions.

Here’s how to do it…

- Login to your SSS online account at https://sss.gov.ph

- Under E-Services, click Apply for SSS Salary Loan

- Right beside Loanable Amount, click the dropdown to check how much you can loan from SSS.

In the screenshot below, the maximum amount that I can loan is P10,000 because I only pay P550 per month as a voluntary member. It could be higher or lower depending on how much you pay for your SSS contribution.

Please take note also that the net amount of the loan shall be the difference between the approved loan amount and all outstanding balance of short-term member loans.

How to Check SSS Loan Status

- Go to https://sss.gov.ph and login with your User ID and Password

- Once logged in, look for E-Services then click Inquiry

- In the Main Menu, look for Loans then click Loan Status/Loan Info. You should be able to see the following:

- Loan Application Details

- Loan Information Details

- List of Availed Loans

- Statement of Account & Loan Payments

- Under Loan Application Details, check to see if your SSS Loan application has been processed and if your check has been generated

Watch this video tutorial for more detailed steps

How and Where to Get SSS Loan Check

For employed members, the check is sent via registered mail to the employer’s address or it may also be picked up by your authorized company representative. Once they have it, they’ll notify you or you can ask them personally.

For voluntary / self-employed members, check is sent via registered mail to the address indicated in the application.

How long is the processing of SSS Loan Application

The processing time for Loan Application is 5 to 10 working days (from filing to check generation) excluding mailing of check which falls under the jurisdiction of PHILPOST.

SSS Loan Payment

A. Payment Terms and Schedule

- The loan shall be payable within 2 years in 24 monthly installments.

- The monthly amortization shall start on 2nd month following the date of loan

- Payment shall be made at any SSS branch with tellering facility, SSS-accredited bank or SSS-authorized payment center.

B. Interest and Penalty

- The loan shall be charged an interest rate of 10% per annum based on diminishing principal balance, and shall be amortized over a period of 24 months

- Interest of 10% shall continue to be charged on the outstanding principal balance until fully paid

- Loan amortization not remitted on due date shall bear a penalty of 1% per month until the loan is fully paid.

- Any excess in the amortization payment shall be applied to the outstanding principal balance

C. Service Fee

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

D. Other Conditions for Employed Members

- For employed members, your employer shall be responsible for the collection and remittance to the SSS of the amortization due on your salary loan through payroll deduction.

- In the event that you resign or transfer employment, you shall submit to your new employer an updated statement of account of any outstanding loan balance with SSS and allow your employer to deduct from your salary the corresponding amortization due, including any interest/or penalty for late remittance.

For more information about salary loan terms and conditions, you may visit the SSS website.

Where to Get SSS Loan Payment Form

For voluntary and self-employed members, you can get a copy of this at the SSS branch or you can download the SSS Loan Payment Form here.

For your first loan payment, SSS advise to pay it at the SSS branch for proper posting on your SSS account. And for the following payments, you may pay it at the accredited payment centers or online partners.

How to do SSS Loan Balance Inquiry

To view your Outstanding Loan Balance, follow the steps above, then click the Statement of Account and Loan Payment, which you can find on the top left of the page.

The TOTAL Amount of Obligation is your Outstanding Loan Balance.

It is the sum of the Amount Not Yet Due and the Total Amount Due (Past + Current Due) including the penalties and interests (if there’s any).

To see your loan payments, check Credited Payments at the lower part of the page.

When Can You Apply for SSS Loan Renewal

- SSS Loan Renewal shall be allowed after payment of at least 50% of the original principal amount and at least 50% of the term has lapsed.

- Proceeds of renewal loan is any amount greater than or equal to zero as long as the outstanding balance on the previous loan is deducted.

What to do if you failed to pay your SSS Loan

If you missed or failed to pay your SSS Loan amortizations, you may go to the nearest SSS office to verify your loan status and update your loan balance and payment terms.

Right now, the SSS is offering SSS Loan Restructuring Program (LRP) for delinquent member-borrowers to regain their good SSS standing and enjoy SSS benefits and privileges in the future. This is by cleaning up their overdue loan principal and interest in full or by installment under a restructured term depending on their capacity.

How to Apply for SSS Loan Restructuring Program (LRP)

If you have overdue loans with SSS, you should take advantage of this SSS Loan Restructuring Program to lessen the amount of your loan balance.

Take note that this is available from April 28, 2016 to April 27, 2017.

Here are the steps on how to apply for SSS LRP, or also known as SSS Condonation:

- Request 2 copies of your Statement of Loan Balances for SSS Loan Restructuring Program from the nearest SSS branch.

- Get a copy of Affidavit of Residency at the SSS branch (or click the link to download) to attest your home address or work address in a covered calamity area when the calamity or disaster happened. Have this notarized (look for a Notary Public Office nearby) before submitting to the SSS branch.

- Get a copy of SSS Loan Restructuring Program Form at the SSS branch or click the link to download.

- If you’re applying personally for SSS Loan Restructuring Program, prepare 2 valid IDs for verification.

- If a representative is filing this form, submit the following:

- Original Copy of Special Power of Attorney (SPA)

- Photocopy of 2 valid IDs each of the member-borrower and the filer (or representative). At least 1 of these valid IDs with photo and both valid IDs with signature should be present and must be original.

Read this article for more details about SSS Loan Restructuring Program.

Or watch this video tutorial:

This blog post answer the following F.A.Q and we hope you found this article helpful.

1. How to loan in sss?

2. How to apply sss loan online?

3. How to check sss loan status?

4. How to pay sss loan?

5. How to check sss loan balance?

Contact SSS

For verification and other inquiries, please contact SSS directly through the following:

- SSS Call Center: 920-6446 to 55

- SSS Email: member_relations@sss.gov.ph

- SSS Facebook: https://www.facebook.com/SSSPh

- SSS Website

Do you have also table how much i can loan on my third loan on SSS. My contribution monthly was in range of 1,200-1,500

i have worked in meralco for 5 years back in 1983-88, and contributed 5 years to sss, can i still apply for loan?

sakin nakapangalan pero binigay ko lang din sa sister ko. okay lang naman un. they’re just after the voucher number. they just need to verify the name of the person who purchased it online.