Are you tired of endlessly scrolling through real estate listings, only to find properties that are way over your budget?

What if we told you that you could own a piece of prime Philippine real estate without breaking the bank?

PAG-IBIG Fund, also known as the Home Development Mutual Fund (HDMF), offers a wide range of foreclosed properties that could be the answer to your property hunting woes.

But, we understand that the process of buying foreclosed properties can be intimidating, especially if you’re new to it.

Fear not, because in this ultimate guide, we’ll walk you through everything you need to know about buying PAG-IBIG foreclosed properties in the Philippines. From insider tips on finding the best deals to a step-by-step guide on completing the necessary paperwork, we’ve got you covered.

So, are you ready to unlock the secrets of PAG-IBIG foreclosed properties and become a property owner? Let’s dive in!

Why Invest in PAG-IBIG Foreclosed Properties?

Are you looking for a real estate investment opportunity in the Philippines? One option to consider is buying PAG-IBIG foreclosed properties. Here are a few reasons why:

- Affordability: PAG-IBIG foreclosed properties are often sold at a lower price compared to brand-new properties or those in the secondary market. This makes them a more affordable option for those who are on a budget but still want to invest in real estate.

- Potential for High Returns: Since PAG-IBIG foreclosed properties are sold at a lower price, there is a potential for high returns on investment. You can either rent out the property or sell it at a higher price once you’ve made some improvements to it.

- Wide Range of Properties: PAG-IBIG foreclosed properties come in a variety of types, sizes, and locations. Whether you’re looking for a residential property, commercial property, or vacant lot, you’re sure to find something that fits your needs and preferences.

Additionally, buying a PAG-IBIG foreclosed property is a great way to support the government’s efforts to provide affordable housing for Filipinos. By investing in a foreclosed property, you’re helping to give a second chance to delinquent borrowers who were not able to pay their loans.

However, it’s important to note that investing in PAG-IBIG foreclosed properties also comes with some risks. Some properties may require significant repairs or renovations, and there may be legal issues to consider. It’s crucial to do your due diligence and thoroughly research the property before making any purchase.

All in all, investing in PAG-IBIG foreclosed properties can be a smart move for those looking to enter the real estate market in the Philippines. With proper research and planning, you can potentially reap high returns on investment while also contributing to the country’s housing initiatives.

READ: How to Avoid Common Mistakes When Buying PAG-IBIG Foreclosed Properties

The Benefits of Buying PAG-IBIG Foreclosed Properties

Affordability

One of the biggest advantages of buying PAG-IBIG foreclosed properties is their affordability. These properties are often sold at a lower price than their market value, making them an attractive option for budget-conscious buyers.

In addition, PAG-IBIG offers financing options for their foreclosed properties, making it easier for you to purchase your dream home. With lower interest rates and longer payment terms, you can enjoy a more affordable and manageable monthly payment.

Location

PAG-IBIG foreclosed properties are located all over the Philippines, from bustling cities to serene provinces. This means that you have a wide range of options to choose from, depending on your preferred location and lifestyle.

Moreover, many of these properties are located in prime areas, such as near business districts, schools, hospitals, and other important establishments. This makes them a convenient choice for those who want to live close to their workplace or other essential amenities.

Security of Investment

Investing in PAG-IBIG foreclosed properties is a smart choice because it offers a high level of security for your investment. Since these properties are owned by a government agency, you can be assured that they are legitimate and free from any legal issues.

In addition, PAG-IBIG conducts due diligence on all their foreclosed properties to ensure that they are in good condition and have no hidden defects or problems. This means that you can have peace of mind knowing that you are investing in a quality property that will appreciate in value over time.

READ: The Pros and Cons of Buying PAG-IBIG Foreclosed Properties

How to Find PAG-IBIG Foreclosed Properties

If you’re looking to buy a foreclosed property in the Philippines, PAG-IBIG is a great place to start. Here are two ways to find PAG-IBIG foreclosed properties:

Online Listings

PAG-IBIG maintains an online database of foreclosed properties that are available for sale. To access this database:

- Go to the PAG-IBIG Fund website

- Click on the “Property Finder” link

- Click the “Properties Under Negotiated Sale” button

- Select your preferred location (province and municipality) and price range from the drop-down menu

- Click the “Search” button

You’ll be presented with a list of foreclosed properties that match your search criteria. Each property listing includes information about the property, such as its location, lot area, floor area, and selling price. Make sure to do your due diligence before submitting a bid, as some properties may have liens or other encumbrances.

Public Auctions

PAG-IBIG also holds public auctions of foreclosed properties throughout the year. To participate in a public auction:

- Check the PAG-IBIG website for a list of upcoming auctions

- Choose the auction that you’re interested in attending

- Register for the auction by submitting the required documents

- Attend the auction and bid on the properties that you’re interested in

Keep in mind that properties sold at public auction are typically sold on an “as-is, where-is” basis, so make sure to inspect the property thoroughly before bidding. You should also set a maximum bid amount beforehand to avoid getting caught up in a bidding war and overpaying for the property.

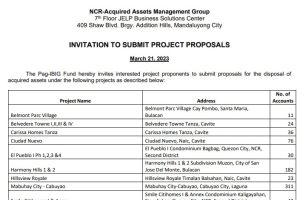

List of Pag-IBIG Foreclosed Properties in NCR – April 2023

General Guidelines

1. The project is open to any of the following who intend to enter into an agreement with the Pag-IBIG Fund for the

rehabilitation/improvement and sale of the Pag-IBIG Fund’s acquired assets:

- a. Developers

- b. Contractors

- c. Employers

- d. Local Government Units

- e. Individuals

2. To qualify, the project proponent must meet the following criteria:

- a. Has legal personality to enter into contract;

- b. No pending Cease and Desist Order (if applicable);

- c. Compliant with the nationality and ownership requirements under the Constitution and other applicable lawsand issuances;

- d. Has sufficient funding to finance the improvements of the Real and Other Properties Acquired (ROPA) for two cycles (quarterly) of scheduled deliveries, as evidenced by any of the following:

- Cash Deposits

- Bank Guaranty/Stand-by Letter of Credit HQP-AAF-075 *subject for adjustment on number of accounts and inventory value (December 2012)

- Bank Credit Line

- Agreement with Suppliers and/or Contractors

3. Interested project proponents may secure the Checklist of Requirements from Marketing and Sales Department located at 7th Floor JELP Business Solutions Center 409 Shaw Blvd. Brgy. Addition Hills, Mandaluyong City or download at www.pagibigfund.gov.ph.

4. Complete eligibility requirements and technical and financial proposals shall be submitted on or before 4:00 PM of April 21, 2023.

5. All interested project proponents are encouraged to inspect the said properties before submitting their proposals.

6. Please expect to receive phone/cellphone calls and notices relative to the approval/disapproval of proposals. The results will also be posted at the Pag-IBIG Fund Official Website at www.pagibigfund.gov.ph.

7. The winning project proponent shall enter into a Memorandum of Agreement (MOA) with Pag-IBIG Fund providing the terms and conditions of the rehabilitation/improvement and sale of Pag-IBIG Fund’s acquired assets based on the Fund’s existing policies and guidelines.

8. For inquiries, interested parties may visit our office or coordinate with Ms. Rhodora D. Atil, Ms. Jodee N. Montealegre, Ms. Paula Bianca Abordo, Mr. Nathaniel Ace Reyes or Ms. Elaine Magpayo of the Marketing and Sales Department at telephone no/s (02) 8654-1398 or (02) 8654-9244. You may also email your concerns at masd.is@pagibigfund.gov.ph.

Important: THE Pag-IBIG FUND RESERVES THE RIGHT TO REJECT ANY OR ALL OFFERS FOR MEMORANDUM OF AGREEMENT WITH PROJECT PROPONENT (MOAPP), TO WAIVE ANY DEFECT OR INFIRMITY IN THE SUBMITTED OFFER TO PURCHASE, AND TO ACCEPT SUCH OFFERS AS MAY BE ADVANTAGEOUS TO THE FUND.

Tips for Buying PAG-IBIG Foreclosed Properties

If you’re planning to buy PAG-IBIG foreclosed properties, here are some tips that can help you make the right decision:

Do Your Research

Before buying any property, it’s important to do your research. This includes researching the location, the condition of the property, and the price. You can check PAG-IBIG’s website for a list of foreclosed properties. You can also visit the property to see it for yourself and check if it’s worth buying.

Inspect the Property

Inspecting the property is crucial before making a purchase. You should check the property’s condition, including the plumbing, electrical, and structural systems. You can also hire a professional inspector to help you assess the property’s condition. This will help you avoid any surprises and costly repairs in the future.

Understand the Buying Process

Buying a foreclosed property from PAG-IBIG has a different process than buying a regular property. You should understand the process, including the requirements, fees, and paperwork. You can visit PAG-IBIG’s office to get more information about the process and ask any questions you may have.

Prepare Your Finances

Buying a foreclosed property requires a significant amount of money upfront. You should prepare your finances and make sure you have enough funds to cover the purchase price, taxes, and other fees. You can also explore financing options, such as PAG-IBIG housing loans, to help you with the purchase.

Conclusion

Congratulations! You have reached the end of our guide to buying PAG-IBIG foreclosed properties in the Philippines. We hope that you have found this guide informative and helpful in your search for your dream home or investment property.

Remember that buying a foreclosed property can be a great way to save money, but it also comes with some risks. You need to do your due diligence before making an offer, and make sure that you have enough funds to cover the purchase price, closing costs, and any repairs or renovations that may be needed.

When buying a foreclosed property from PAG-IBIG, you have two options: public auction or negotiated sale. Public auctions can be competitive and fast-paced, while negotiated sales offer more flexibility and less competition. Choose the option that works best for you and your budget.

Before making an offer, make sure that you have all the necessary documents and requirements, such as a valid ID and a proof of income. You should also inspect the property thoroughly and assess its market value to determine a fair offer price.

Lastly, be patient and persistent. The process of buying a foreclosed property can be lengthy and challenging, but it can also be rewarding in the end. With the right mindset and strategy, you can find the perfect property that fits your needs and budget.

Written: March 10, 2018

Are you looking for a cheaper and affordable real estate investment?

Why not consider purchasing foreclosed properties or those that have been acquired by the bank or financial institutions, from previous owners or borrowers who failed to pay their loans?

Pag-IBIG Fund is one of the institutions that offers acquired or foreclosed properties through public auctions.

Pag-IBIG Fund posts their announcements for public auction schedules and lists of foreclosed properties on their website every single month.

For the month of March 2018, the Pag-IBIG Fund will hold public auctions of foreclosed properties in different venues across the Philippines including NCR, Pampanga, La Union, Naga, and Cebu.

In this article, we will share with you the list of properties available for auction in NCR.

NCR Public Auctions of Pag-IBIG Foreclosed Properties

In NCR, the public auction will be held on March 21-22, 2018 at the Roofdeck, JELP Business Solutions Center, 409 Shaw Blvd., Mandaluyong City

- 258 units in Batangas, Bulacan, Cavite, Laguna, Metro Manila and Rizal will be auctioned out on March 21

- 272 units in Bulacan, Cavite, Laguna, Metro Manila and Rizal will be auctioned out on March 22

The list of available foreclosed properties in NCR include prime properties, condominium units, lots only, single detached, single attached, double attached, duplex, quadruplex, town house, and row house.

In the list of properties below, only selected units are available in the respective subdivisions, villages, or areas. To see the actual unit number and complete address and to know if the unit is still occupied or not, click here.

Prime Properties

CAVITE

- Mary Homes – Bacoor City

- Montefaro Village – Imus City

- Green Estate – Imus City

- Greenmark Homes – Imus City

- Summer Pointe Country Homes – Imus City

LAGUNA

- Southern Heights I – San Pedro

METRO MANILA

- Wonderland Townhomes – Mandaluyong

- North Olympus Subdivision – Quezon City

Condominium Units

METRO MANILA

- Smile Citihomes Annex – Caloocan City

- Smile Citihomes – Quezon City

Lots Only

CAVITE

- Crystal Aire Vill – General Trias, Cavite

- Carissa Homes Tanza-Punta – Tanza, Cavite

LAGUNA

- South Fairway Homes Classic – San Pedro, Laguna

RIZAL

- Medalva Hills Village – Angono, Rizal

- Mabuhay Homes 2000 Darangan – Binangonan, Rizal

- Liro Homes – Tanay, Rizal

Single Detached

CAVITE

- Ciudad Adelina – Trece Martires City, Cavite

RIZAL

- Liro Homes – Tanay, Rizal

Single Attached

CAVITE

- Sunshine County – General Trias, Cavite

- Hauskon Homes-Julugan – Tanza, Cavite

- La Paz Homes II – Trece Martires City, Cavite

- Ciudad Adelina – Trece Martires City, Cavite

LAGUNA

- Golden City Sta Rosa (Mabuhay Homes 2000) – Santa Rosa, Laguna

RIZAL

- Eastwood Residences – Rodriguez (Montalban), Rizal

- Metro Manila Hills – Rodriguez (Montalban), Rizal

Double Attached

CAVITE

- Summer Pointe Country Homes – Imus City, Cavite

Town House

BULACAN

- Deca Homes – Marilao, Bulacan

CAVITE

- Holiday Homes – General Trias, Cavite

- Tierra Grande Royale – General Trias, Cavite

- Green Estate – Imus City, Cavite

- Greengate Homes – Imus City, Cavite

- Camella Homes Barcelona 1 – Imus City, Cavite

- The Veraneo – Kawit, Cavite

- Boston Heights Subd – Kawit, Cavite

- Estrella Homes 4 – Kawit, Cavite

- Kawit Municipal Housing (Kalayaan Homes) – Kawit, Cavite

- Greenville Homes – Tanza, Cavite

LAGUNA

- Lakeside Nest – Cabuyao City, Laguna

- Celestine Ville – Cabuyao City, Laguna

- Mahogany Villas – Calamba, Laguna

METRO MANILA

- Celina Homes II – Caloocan City

- Kalikasan Hills – Caloocan City

RIZAL

- Mediterranean Heights – Rodriguez (Montalban), Rizal

- Metro Manila Hills – Rodriguez (Montalban), Rizal

Duplex

CAVITE

- Parklane Country Homes – General Trias, Cavite

- Camella Homes Barcelona 3 – Imus City, Cavite

- Sheltertown – Imus City, Cavite

- Asama Homes – Indang, Cavite

- Landmass Park Subd – Tanza, Cavite

- Ciudad Adelina – Trece Martires City, Cavite

- Capitol Hills Executive Subdivision – Trece Martires City, Cavite

RIZAL

- Liro Homes – Tanay, Rizal

Quadruplex

CAVITE

- Parklane Country Homes – General Trias, Cavite

- Carissa Homes Tanza-Punta – Tanza, Cavite

Row House

BATANGAS

- Blue Isle I – Santo Tomas, Batangas

- Blue Isle III – Santo Tomas, Batangas

BULACAN

- Evergreen Heights Subdivision – San Jose Del Monte, Bulacan

- Carissa Homes North 1C – San Jose Del Monte, Bulacan

- Northwinds City – San Jose Del Monte, Bulacan

- Deca Homes – Marilao, Bulacan

- Belmont Parc Village – Santa Maria, Bulacan

- Las Palmas – Santa Maria, Bulacan

CAVITE

- Greentown Villas I – Bacoor City, Cavite

- Village Park Subdivision – Dasmarinas, Cavite

- Mabuhay Homes 2000 – Dasmarinas, Cavite

- Ch San Marino South 2 – Dasmarinas, Cavite

- Holiday Homes – General Trias, Cavite

- Tierra Grande Royale – General Trias, Cavite

- ACM Paramount Homes – General Trias, Cavite

- ACM Woodstock Homes Navarro – General Trias, Cavite

- Camachile Subd – General Trias, Cavite

- Belmont Hills I – General Trias, Cavite

- Belvedere Towne III – General Trias, Cavite

- Country Meadows – General Trias, Cavite

- Sunny Brooke – General Trias, Cavite

- Mary Cris Complex – General Trias, Cavite

- Parklane Country Homes – General Trias, Cavite

- ACM Woodstock Homes Alapan – Imus City, Cavite

- Mary Cris Homes – Imus City, Cavite

- California West Hills – Imus City, Cavite

- ACM Woodstock Homes – Imus City, Cavite

- Chateau L’ Ermitage – Imus City, Cavite

- Green Estate – Imus City, Cavite

- Kawit Municipal Housing (Kalayaan Homes) – Kawit, Cavite

- Villa Apolonia 2 – Naic, Cavite

- Hillsview Royale – Naic, Cavite

- Buklod Bahayan – Silang, Cavite

- Carissa Homes Tanza-Bagtas – Tanza, Cavite

- Belvedere Towne I – Tanza, Cavite

- ACM Woodstock Homes Sanja Mayor – Tanza, Cavite

- Lhinette Homes – Tanza, Cavite

- Sunrise Place – Tanza, Cavite

- La Paz Homes II – Trece Martires City, Cavite

- La Trinidad Subdivision – Trece Martires City, Cavite

- Ciudad Adelina – Trece Martires City, Cavite

- Capitol Hills Executive Subdivision – Trece Martires City, Cavite

LAGUNA

- Lakeside Nest – Cabuyao City, Laguna

- Extra Ordinary Homes – Cabuyao City, Laguna

- Mabuhay City Value Homes – Cabuyao City, Laguna

METRO MANILA

- Tierra Nova Royale III – Caloocan City

- Violago Homes Parkwoods – Quezon City

RIZAL

- Mabuhay Homes 2000 Darangan – Binangonan, Rizal

- Robinsons Homes East I – Antipolo, Rizal

- Peace Village – Antipolo, Rizal

- Green Breeze – Rodriguez (Montalban), Rizal

- Sta Barbara Villas – San Mateo, Rizal

How to Join the Auction of Foreclosed Properties

1. If you found a property that you’re interested in purchasing, you may secure copies of the following documents from the Technical Working Group (TWG) on the venue or may download the forms at www.pagibigfund.gov.ph (link Disposition of Acquired Assets for Public Auction).

- INSTRUCTION TO BIDDERS (HQP-AAF-104) and

- OFFER TO BID (HQP-AAF-103)

2. Please take note that these acquired or foreclosed properties shall be sold on an “AS IS, WHERE IS” basis.

3. You are highly encouraged to inspect the property/ies before tendering your offer to join the bidding.

4. Always check the Pag-IBIG Fund website for updates on the list of Pag-IBIG Foreclosed Properties and to know if they’re still available or if new guidelines have been posted.

5. Prepare enough funds to be able to join the bidding. The Bid Offer shall not be lower than the minimum bid set by Pag-IBIG Fund.

How to Inquire at Pag-IBIG Fund?

For your inquiries about the acquired or foreclosed properties of Pag-IBIG Fund, you may contact the Acquired Assets Management through the following staff:

- MS. ROSCIEL A. BRIONES

- MR. CONAN G. ACENAS

- MS. KHEENEE O. ARNEJO

- MR. VICENTE G. DONIEGA

- MR. JON VERNARD A. MERANIO

Their contact number is (02) 654-9244. You may also email your inquiries to aad_ms@pagibigfund.gov.ph.

RELATED ARTICLES:

- How to buy your own house with Pag-IBIG Fund Affordable Housing Program

- Where to Find Affordable Houses for Sale in the Philippines

- How to Apply for BDO Home Loan – Requirements and Procedures

RELATED VIDEOS:

- Steps in Buying Pag IBIG Acquired Assets or Foreclosed Properties

- Pag IBIG Foreclosed Properties Requirements

- How to Find Pag IBIG Acquired Assets Online in Pag IBIG Fund Website

Reading your article helped me a lot and I agree with you.