Owning a house is one of the ultimate dreams of many Filipinos.

Others even work abroad to realize their dream because they think that they may not be able to afford to buy a house if they just work locally.

Little did we know that Pag-IBIG actually offers housing programs that are not only available to high-salaried employees, but also to minimum-wage earners.

What is Pag-IBIG Fund Affordable Housing Program (AHP)?

The Affordable Housing Program (AHP) is Pag-IBIG Fund’s program that aims to help minimum-wage earners buy their own house and lot by providing a loan that is easy to pay for through its very low-interest rates. The loan is payable over a maximum period of 30 years.

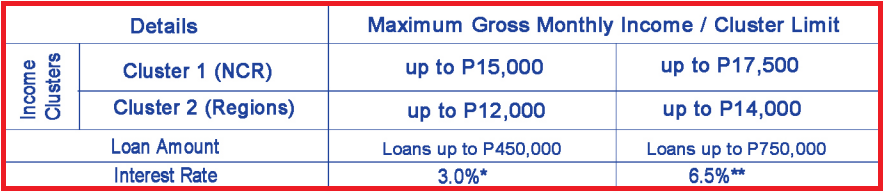

Minimum-wage earners who can avail of the AHP are those whose gross monthly income doesn’t exceed P17,500 and are members of the Pag-IBIG Fund.

Where can you use this Loan?

Qualified members who apply for the Pag-IBIG Fund Affordable Housing Program (AHP) may use the loan to finance any one or a combination of the following loan purposes:

- to purchase a fully-developed residential lot (adjoining residential lots included) that do not exceed 1,000 square meters.

- to purchase a new or pre-owned residential house and lot, townhouse or condominium unit (adjoining units included) that are mortgaged and/or an acquired asset of the Pag-IBIG fund

- to construct or complete a residential unit on a lot owned by the borrower or a relative of the borrower

- to refinance an existing housing loan

- for home improvement

Who are eligible to apply and what are the requirements for AHP?

The Affordable Housing Program can be availed by Pag-IBIG Fund active members, including OFWs, who are not more than 65 years old as of the date of application and must be insurable.

The member must have made at least 24 monthly savings or he/she can make a lump sum payment of the required 24 monthly savings to avail of the AHP.

The gross monthly income of the member must not exceed P17,500 and he/she must have the legal capacity to acquire and encumber a real property.

If you have an existing Pag-IBIG housing account, it must be updated and you must not have any Pag-IBIG housing loan that was foreclosed, canceled, bought back due to default, or subjected to dacion en pago. You must not also have any outstanding Pag-IBIG Short-Term Loan in arrears when you apply for the loan.

And last, but not the least, you should have passed satisfactory background, credit and employment or business checks of Pag-IBIG Fund.

Loanable Amount, Interest Rate, and Loan Term

You may borrow as much as P750,000 from the Pag-IBIG Fund, but the actual amount will be based on the lowest of the following:

- member’s actual need

- loan entitlement based on gross monthly income and capacity to pay

- loan-to-appraised value ratio

The interest rate will be repriced at the end of the 5-year or 10-year period, based on the prevailing interest rate in the Fund’s Full Risk-Based Pricing (FRBP) Framework.

The maximum repayment period for the loan is 30 years.

If you opt for a 30-year or 5-year fixing period, the interest rate will be increased by 2% or will be repriced based on the prevailing interest rate in the FRBP Framework, whichever is lower.

How to Apply for Pag-IBIG Fund Affordable Housing Program (AHP)?

1. Online Housing Loan Application (OHLA)

If you are interested to apply for the Pag-IBIG Housing Loan, you may schedule an appointment through Online Housing Loan Application (OHLA) for the submission of your Housing Loan Application Form and requirements.

Take note that you can only schedule an appointment, but there is NO online submission of the Application Form and requirements.

- Applicants with a high loan amount and had a good initial credit rating, will be contacted by the Institutional Housing Department for the submission of the required documents via email to expedite their process.

To get a schedule online, click this link to visit the Pag-IBIG Housing Loan page.

Scheduling through this online system requires any of the following info of the member-applicant for log-in and security purposes:

- the Pag-IBIG Membership Identification Number (MID) or

- the Registration Tracking Number (RTN) or

- the Temporary Identification

The system will assign a Housing Loan Application Tracking Number to the member-applicant, which will serve as a unique reference number.

To accomplish the online form, the member-applicant must provide the following Loan Information:

- Purpose of the loan, mode of payment, desired loan term, and desired re-pricing period

- Personal Information including the email address, mobile number, home ownership, years of stay in present home address, occupation, years of employment or business, number of dependents, gross monthly income, and his/her preferred Pag-IBIG office where application and requirement will be submitted.

Click “Submit” after you have filled out the online application form.

You will then receive an email from Pag-IBIG Fund with the schedule for the submission of Application Form and requirements, the name of the Pag-IBIG contact person, and address of the Pag-IBIG office where application and requirement will be submitted.

You will also receive your reference number via SMS or text message.

Why schedule an appointment online?

Because you will be given priority over walk-in applicants as there is a special lane in Pag-IBIG branch offices available for those who made an online schedule.

2. Apply for Pag-IBIG Housing Loan over the counter

If for any reason you can’t or you don’t want to schedule an appointment online, you can file your housing loan application personally at the Pag-IBIG Fund Servicing Department, 2/F JELP Business Solutions, 409 Shaw Blvd., Mandaluyong City or at any Pag-IBIG branch office of your choice.

Conclusion

If you’re tired of renting and you want to finally have a home that you can call your own, this Affordable Housing Program of Pag-IBIG Fund can help you.

You don’t need to go abroad to be able to buy your own house especially if you don’t want to be separated from your loved ones.

As minimum-wage earners, you too can avail now of a housing loan to pay for your dream house without compromising your other personal needs.

RELATED ARTICLES:

- How to Avail of Pag-IBIG Fund Housing Loan

- Pag-IBIG Foreclosed Properties

- Affordable Houses for Sale in the Philippines

RELATED VIDEOS:

- Steps in Buying Pag IBIG Acquired Assets or Foreclosed Properties

- Pag IBIG Foreclosed Properties Requirements

- How to Find Pag IBIG Acquired Assets Online in Pag IBIG Fund Website

[…] How to buy your own house with Pag-IBIG Fund Affordable Housing Program […]