Are you a voluntary member of the Pag-IBIG Fund? Do you want to know to pay your monthly savings and/or your housing loan amortization to Pag-IBIG?

There are many ways to pay your monthly savings and housing loan to Pag-IBIG Fund. You can pay over-the-counter, through credit card, or through Globe G-Cash.

In this article, you’ll know the step by step process on how to pay your Pag-IBIG savings and housing loan through these three options.

1. Over-the-Counter

You can pay your monthly savings and housing loan over-the-counter at any Bayad Center and SM Business Centers including Savemore and Hyper Market.

You can also pay your housing loan at Metrobank and Land Bank of the Philippines.

To pay your monthly savings to Pag-IBIG Fund over-the-counter, just to go to any of the above-mentioned accredited collecting agents and follow the instructions below.

- Get a copy of the payment slip for Pag-IBIG Fund.

- Fill it out with all the required information including:

- Pag-IBIG Membership Identification (MID) Number or Registration Tracking Number (RTN)

- Member or Account Name

- Payment Type (example, MSS-Individual Payor)

- Amount

- Period Covered

- Contact No.

- E-mail Address

- For Check payment, indicate the Check No. and Amount of Payment

To pay your Housing Loan Amortization to Pag-IBIG Fund, just follow the following steps whether you have a Housing Loan Billing Statement or with SMS Text Blast.

a. With Housing Loan Billing Statement

If you have a current Housing Loan Monthly Billing Statement (BS), present it and then pay your amortization. You will then receive the machine-validated Billing Statement indicating the Transaction Reference No. (TRN). This will serve as your official receipt in place of Pag-IBIG Fund Receipt (PFR).

b. With SMS Text Blast

If you received the text blast from Pag-IBIG Fund that indicates the due date, amount due, Payment Reference Number (PRN), you must present it, then fill out and submit the Payment Slip, pay your Housing Loan Amortization.

You will then receive the Transaction Receipt or the machine-validated Payment Slip indicating the Transaction Reference No. (TRN). This will serve as your official receipt in place of Pag-IBIG Fund Receipt (PFR).

2. Credit Card

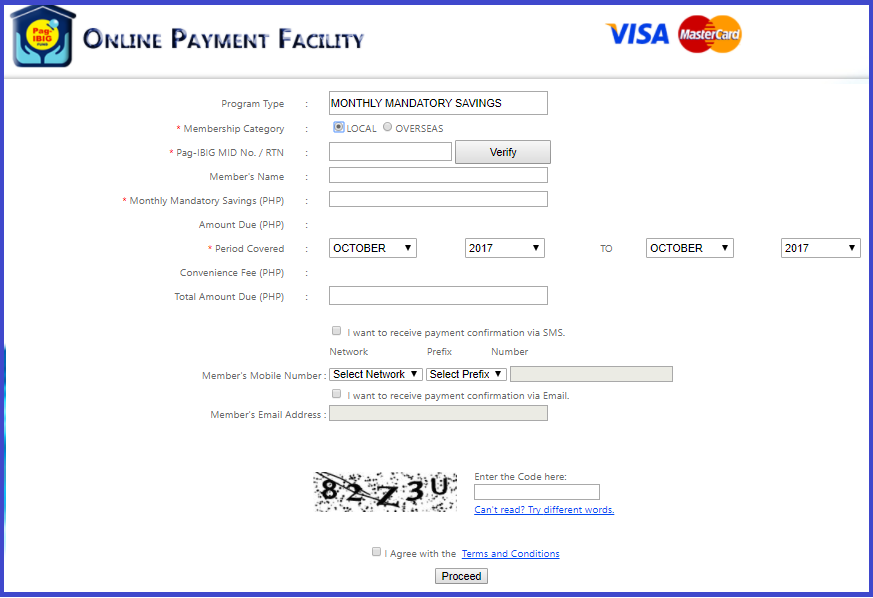

To pay your Pag-IBIG monthly savings through your credit card, visit the Pag-IBIG website, and click Online Payment Facility under Other Services.

- Fill out the form with all the required information including:

- Membership Category (Local or Overseas)

- Pag-IBIG Membership Identification (MID) No./Registration Tracking No. (RTN)

- Monthly Savings (Amount Due)

- Period Covered

- Member’s Cell Phone Number/Email Address

Once you MID No. has been validated, the member’s name will automatically appear. And once the corresponding monthly savings is encoded, the Total Amount Due to be deducted from the credit card will be displayed including the Convenience Fee charged.

Please note that the system will only accept payment for current and future monthly savings. It will not accept retroactive payments.

- Select what mode will be used for receiving the payment confirmation (thru SMS [member’s cell phone number] and/or Email [member’s email address]) and supply the needed cell phone number and/or email address.

- Enter the CAPTCHA code and click to agree “Terms and Conditions” and “Proceed.”

- The system will display “Payment Summary.” You will be asked to check payment details prior to proceed with payment and click “Submit.”

- Choose what Credit Card will be used for payment (either Visa or Mastercard).

- Accomplish and confirm required credit card details (i.e., credit card no., expiration date of credit card, credit card verification no., etc.).

Once the payment transaction is completed, the Payment Result will be displayed reflecting the Merchant Reference No. and Payment Reference No. This will serve as proof of your payment. You will then receive an SMS or Email notification concerning credit card transaction.

3. Globe G-Cash

You can also pay your Pag-IBIG monthly savings and housing loan amortization through Globe G-Cash.

Step 1 – The first thing you need to do is to register to Globe G-Cash and there are two ways to do this.

a. Thru USSD (Unstructured Supplementary Service Data)

This is a protocol used by GSM cellular telephones to communicate with the service provider’s computers.

This is free of charge. To register, dial the mobile network (*143#) and select “GCASH” and “REGISTER.” After that, enter the following required details:

- 4-digit MPIN

- Mother’s Maiden Name

- First Name

- Last Name

- Address

You need to enter the “Registration Code”. After you confirm your details, click to agree on the “Terms and Conditions.”

Once the transaction is successfully completed, you will receive an acknowledgment with the Reference No. and an instruction to change the registered MPIN for security purposes.

b. Thru Text-based

This option will cost you P1.00 per text. To register, just enter the following required details on your mobile phone:

- REG <space> 4-digit MPIN/Mother’s Maiden Name/ First Name/Last Name/Address

Please take note that there are no spaces before and after the /. You must enter the same information that is on your valid ID so that you won’t encounter issues later.

Afte confirming the details that you entered, send the text message. Once the transaction is successfully completed, you will receive an acknowledgment with the Reference No. and an instruction to change the registered MPIN for security purposes.

Step 2 – After you registered to Globe G-Cash, you will need to perform Cash-in. To do this, just follow the steps below.

a. Fund your G-Cash account thru any of the following options:

- Online Bank Transfer

- G-Cash Outlets

- Mobile Phone Banking

- BancNet ATM

b. Fill out and submit the Service Form (for KYC) with your valid ID to any G-Cash Business Centers.

Please take note that the registered G-Cash member may opt to undergo “Knowing Your Customer” (KYC) process to fund the G-Cash account up to maximum amount of Php 100,000 and allow a phone-to-phone money transfer

Another thing is that the registered G-Cash member may only fund his/her G-Cash account up to maximum amount of Php 40,000 without the KYC process.

Step 3 – Once your G-Cash account has been funded, you need to dial your mobile network, select “Pay Bills” and perform the following for payment:

a. For payment of Monthly Savings or Modified Pag-IBIG II (MP2)

1. Enter the following required details:

- 4-digit MPIN

- Amount to be paid

- Pag-IBIG MID No. (for MS)/Account No. (for MP2)

- Period Covered

2. Once payment details are accomplished, a Transaction Summary will be displayed reflecting the program type and amount. You then need to confirm the amount, type of transaction and MID No. to complete the transaction.

Please take note of the minimum amount for payment:

- P100.00 for regular Pag-IBIG monthly savings

- P500.00 for Modified Pag-IBIG II

3. Upon confirmation, you will receive an acknowledgment with the following details:

- Amount sent

- Date of transaction

- MID No.

- New GCASH balance

b. For payment of Housing Loan Amortization

To pay your Pag-IBIG Housing Loan amortization, just follow the same steps as above except that instead of the Pag-IBIG MID No., you will have to provide your Payment Reference No. or PRN which is found in the upper right portion of the HL Billing Statement.

Click here to read:

- How to Increase your Savings with Pag-IBIG Fund

- How to Avail of Pag-IBIG Fund Housing Loan

- How to Pay Pag-IBIG Monthly Savings and Housing Loan Abroad – For OFWs

Speak Your Mind