Are you feeling a bit stressed out these days due to lack of money or you have a super tight budget?

I know the feeling and I understand how frustrating it is because I’ve been in the same situation a few times before.

Some of us may have resorted to borrowing money from family and friends but they can only give what they can and it might not be enough for what we need or badly want to buy or pay for.

Thanks to the banks and other financial institutions that offer loans or lending services.

One of them is Banco de Oro or BDO, which is one of the top banks in the Philippines. Whatever your goal is, BDO can help you make your plans happen with their BDO Personal Loan.

You can use your BDO Personal Loan for your house renovation, your kids’ tuition or school needs, vacation or travel, medical emergencies, or other personal purchases.

Who are qualified to apply for BDO Personal Loan?

- Filipino Citizen

- Foreigner residing in the Philippines for more than 2 years

- Age – 21 years old but not more than 70 years old upon maturity

- Minimum Gross Annual Income

- P120,000 for Salaried Employees

- P400,000 for Self-Employed / Professional

- Contact Info – Must have a mobile phone and a landline phone at either residence or office

- Address – Residence or office must be within BDO serviceable area

- Additional Requirements

- Salaried Employees – Must be at least 1-year tenure with the company

- Self-Employed – Must be a sole proprietor or majority part-owner of a company operating for at least 2 years

What are the requirements or documents needed?

For Filipino Applicants

1. Proof of Income for Salaried Employees

What are Interest Rates of BDO Personal Loan?

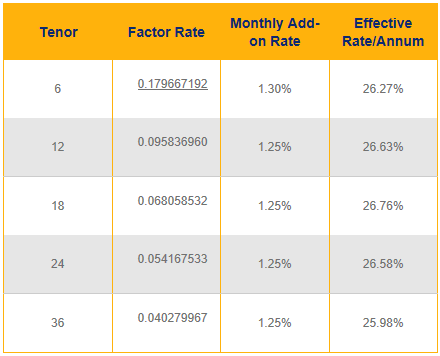

The computation of interest rates for BDO Personal Loans depend on the tenor or the number of years that you’re supposed to pay the loan or payment terms; the factor rate; the monthly add-on rate, and the effective rate per annum.

Please see the table below for the interest rates of BDO Personal Loan.

How to Apply for BDO Personal Loan

You may download the application form online and submit it together with your requirements to the BDO branch. You can also get the application form from the branch.

For inquiries about BDO Personal Loan, you may contact BDO Hotline at 631-8000 or text (via SMS) BDO LOANS to 2256.

Conclusion

Getting a personal loan is a good and helpful option but you should remember that it comes with a big responsibility. When you take out a loan, that means you are willing and committed to pay the monthly amortization until it’s fully paid.

You also have to factor in your personal expenses such as your food and grocery expenses, house or apartment rental or maintenance, and others. Make sure that you don’t compromise your personal needs just to pay your loans.

Only get a loan amount that you think you can afford to pay on a monthly basis without hurting your lifestyle.

Click here to read: How to Apply for BDO Auto Loan

gudpm pwede po ba mag apply kahit remittances lng ang income galing abroad??TIA

pwede po ba ang teacher? pano po kau magdeduct if teacher ang magloan?

Hi Vanessa, yes you may apply for the loan with BDO directly. BDO will assess your requirements and will let you know if you can avail of the loan and their payment options.

pwd po b mg-apply 5 years n ang bussines sari sari store sime grocery typ. pero now lng nkakuha ng municipal bussines permit dati brgy permit lng.

try nyo din po. punta lang kayo sa malapit na bdo branch dala ang mga requirements.

Hi ! pwde rin po ba mag apply if immigrant in Canada ?