Do you have extra funds that you want to save for the future?

Are you planning to open a savings account that offers interest and other useful features?

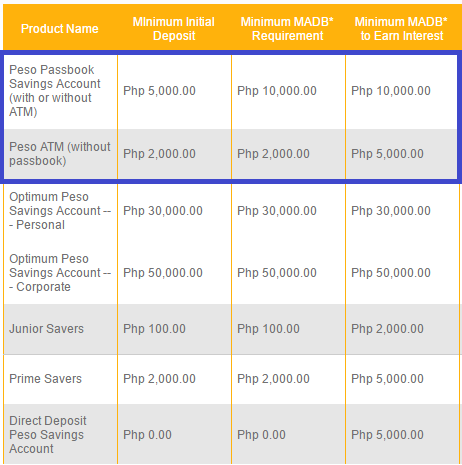

Look no further because Banco De Oro Unibank or BDO offers different types of savings account including Peso Passbook Savings Account (with or without ATM), Peso ATM (without passbook), Optimum Peso Savings Account, Junior Savers, Prime Savers, and Direct Deposit Peso Savings Account.

BDO Passbook Features:

If you want to open Peso Passbook Savings Account, you can choose to have or not have ATM with it. If your intention is really to save money, you may get a passbook without ATM so that it wouldn’t be easy for you to withdraw money especially if you don’t really need it.

- The initial deposit requirement is Php 5,000

- The minimum monthly ADB requirement is Php 10,000

- The minimum balance to earn interest is Php 10,000

- The interest per annum is 0.25%

In terms of services fees and charges:

- Php 300 for account closure with 30 days

- Php 300 for below minimum balance

- 20% withholding tax for interest earned

BDO ATM Features:

- The initial deposit requirement is Php 2,000

- The minimum monthly ADB requirement is Php 2,000

- The minimum balance to earn interest is Php 5,000

- The interest per annum is 0.25%

Service fees and charges are just the same with BDO Passbook.

What are the Requirements to open BDO Savings Account

- 2 valid IDs (original & photocopy)

- TIN (Tax Identification Number)

- Billing statement (to verify your billing address)

- 2 copies of 1×1 photo (bring 2×2 also)

- Initial Deposit

List of Valid IDs:

- Philippine Passport

- Philippine POSTAL ID Card

- Government Service and Insurance System (GSIS) UMID / Unified Multipurpose ID Card

- New Social Security System (SSS) ID with picture

- Driver’s License with validated O.R. from LTO

- R.C. ID / License

- Home Development Mutual Fund (HDMF)

- Voter’s ID

- Senior Citizen ID Card

- Integrated Bard of the Philippines (IBP) ID

- Philippine National Police (PNP)

- Armed Forces of the Philippines (AFP)

- Seaman’s Book

- OFW Card with picture issued by POEA

- Overseas Worker’s Welfare Administration (OWWA) ID Card

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP) of Social Welfare and Development (DSWD) Certification

Steps to Open a Savings Account with Banco De Oro Unibank

Step 1 – Go to the nearest BDO Unibank branch in your area

Step 2 – Get a copy of the Application Form from the BDO bank officer and fill it out with the required information.

Step 3 – Submit your requirements and your Initial Deposit

Step 4 – Wait 1-2 days for your account to be activated and 5-7 days to claim your Passbook and ATM.

Step 5 – Enroll your account in BDO Online Banking

Why BDO Online Banking

It’s highly recommended that you enroll your BDO Savings account in online banking so that it’s easier for you to check your balance, pay your bills, and transfer funds to other BDO accounts.

If you want to open a savings account that has no maintaining balance, check out BDO Cash Card here.

BDO Contact

BDO Hotline: 631-8000

BDO Email: callcenter@bdo.com.ph

BDO Website: www.bdo.com.ph

How can a former Filipino citizen, now a US citizen, open up a BDO bank account?

All the required valid IDs are all specific to Filipino citizens. Are there any foreign country IDs that can be substituted with the valid Philippines’ IDs.

Thanks and have a nice day!

i dont have any billing statement like electricity, water and rent.

but i have a company bpo account for my salary, but i want my own account.